Transferring a business is a complex operation requiring the expertise of a specialist attorney-in-law.

According to a recent study published in August 2021 in AGEFI, 91,360 out of the 603,602 Swiss companies with fewer than 250 employees, that is over 15%, are looking for a successor to their owner aged over 60.

A transfer must be prepared in advance and not improvised at the last minute. The transfer price is far from being the only factor to consider. Transferring a business is a very emotional process which has an impact at every level: legal, financial, accounting, taxation and communication.

The attorney-in-law is a crucial protagonist, playing a cross-cutting role the full length of this process. They do not just check through the final contract; they provide assistance and support during the various stages of the transfer, working alongside the owner/transferor or the purchaser. The attorney-in-law offers objective advice to help the latter to determine what their intentions are and their proposed objectives. The lawyer draws on their own expertise, experience and network to enable these objectives to be achieved.

Transferring a business is a complex and specialised process. Our firm has the expertise, network and experience to ensure the transfer can be completed without unnecessary expense or complication and within the framework of an individual, independent, dedicated relationship.

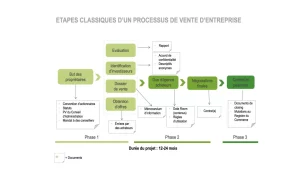

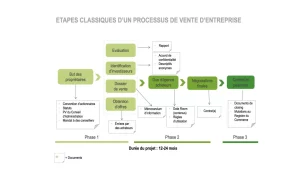

Transferring a business is a complex process. Firstly, the objective to be achieved must be fixed: sale to third parties, takeover by management, takeover within the family. A company valuation then needs to be carried out, which may lead to an overhaul or restructuring. The transfer itself must then be arranged, and all steps taken to ensure that the business operations can be sustained and expanded as far as possible post-transfer.

Only a lawyer can establish a complete overview of the issues. The transfer price is not the only factor to consider. A lawyer specialising in business transfers can anticipate issues that are likely to arise and plan the key steps. They will focus on the essential issues rather than getting side-tracked by legal minutiae. The lawyer can offer their wholly impartial support to the owner at all steps in the procedure. They can advise the owner on the best takeover scenarios. The lawyer can call on their network of expert professionals (fiduciaries/accountants, tax specialists, banks, communications experts) to ensure this complicated operation is successful.

First of all, the general framework for the negotiations will be set out in a letter of intent. Next, steps will be taken to ensure the information provided is kept confidential and the data room set up. Then the sale contract will be drafted. In parallel, careful consideration must be given to the expected tax implications and to the conditions for financing the takeover, because the transferor may remain one of the key players. Communications about the transfer are also of fundamental importance.

Ideally, this should not be done in a hurry. To start with, a ‘health check’ should be conducted on the business ahead of its transfer. The aim of this check-up is to establish an overview of the main legal and financial challenges facing the business and assess the consequences of this when it comes to setting objectives and deciding on the procedure to be followed. This allows the foundations for the transfer strategy to be cemented. In effect, a family business is not transferred within the owners’ family in the same way as it would be in the case of a sale to a competitor or a takeover by a private equity fund.

First of all, it is necessary to analyse and obtain an understanding of the general background to the business. Why is it being transferred, to whom, how and within what time frame?

An analysis of the strengths and weaknesses of the business and its background will then be carried out.

On this basis, a detailed analysis of the financial situation of the business will of course follow. What is it worth? Can this be improved?

Lastly, the contractual and legal framework will be drawn up to enable the objectives defined by the strategy to be achieved.

The preliminary analysis will therefore serve as a guideline or road map. It will be revised regularly during the transfer process and will be followed by a more detailed analysis or subsequent analyses, relating either to variations or specific points relevant to the particular situation of the business, its market, financial or legal circumstances or shareholder situation.

Our law firm has over twenty years’ experience in business transfers. This experience enables our lawyers to anticipate issues that are likely to arise and to advise the owner(s)/transferor(s) on setting realistic, achievable aims which can be implemented at legal, fiscal and financial levels. Our extensive network of independent consultants enables all aspects to be considered and ensure that the overall transfer process can be coordinated.

Our lawyers can certainly advise potential purchasers in relation to the transfer process. They are particularly experienced in offering guidance to foreign purchasers, helping them to navigate the specific features of a takeover process in French-speaking Switzerland, a marketplace densely populated with small and mid-sized companies.

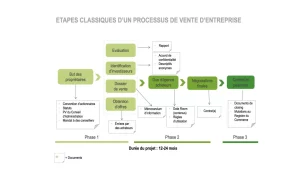

Transferring a business is a complex process. Firstly, the objective to be achieved must be fixed: sale to third parties, takeover by management, takeover within the family. A company valuation then needs to be carried out, which may lead to an overhaul or restructuring. The transfer itself must then be arranged, and all steps taken to ensure that the business operations can be sustained and expanded as far as possible post-transfer.

Only a lawyer can establish a complete overview of the issues. The transfer price is not the only factor to consider. A lawyer specialising in business transfers can anticipate issues that are likely to arise and plan the key steps. They will focus on the essential issues rather than getting side-tracked by legal minutiae. The lawyer can offer their wholly impartial support to the owner at all steps in the procedure. They can advise the owner on the best takeover scenarios. The lawyer can call on their network of expert professionals (fiduciaries/accountants, tax specialists, banks, communications experts) to ensure this complicated operation is successful.

First of all, the general framework for the negotiations will be set out in a letter of intent. Next, steps will be taken to ensure the information provided is kept confidential and the data room set up. Then the sale contract will be drafted. In parallel, careful consideration must be given to the expected tax implications and to the conditions for financing the takeover, because the transferor may remain one of the key players. Communications about the transfer are also of fundamental importance.

Ideally, this should not be done in a hurry. To start with, a ‘health check’ should be conducted on the business ahead of its transfer. The aim of this check-up is to establish an overview of the main legal and financial challenges facing the business and assess the consequences of this when it comes to setting objectives and deciding on the procedure to be followed. This allows the foundations for the transfer strategy to be cemented. In effect, a family business is not transferred within the owners’ family in the same way as it would be in the case of a sale to a competitor or a takeover by a private equity fund.

First of all, it is necessary to analyse and obtain an understanding of the general background to the business. Why is it being transferred, to whom, how and within what time frame?

An analysis of the strengths and weaknesses of the business and its background will then be carried out.

On this basis, a detailed analysis of the financial situation of the business will of course follow. What is it worth? Can this be improved?

Lastly, the contractual and legal framework will be drawn up to enable the objectives defined by the strategy to be achieved.

The preliminary analysis will therefore serve as a guideline or road map. It will be revised regularly during the transfer process and will be followed by a more detailed analysis or subsequent analyses, relating either to variations or specific points relevant to the particular situation of the business, its market, financial or legal circumstances or shareholder situation.

Our law firm has over twenty years’ experience in business transfers. This experience enables our lawyers to anticipate issues that are likely to arise and to advise the owner(s)/transferor(s) on setting realistic, achievable aims which can be implemented at legal, fiscal and financial levels. Our extensive network of independent consultants enables all aspects to be considered and ensure that the overall transfer process can be coordinated.

Our lawyers can certainly advise potential purchasers in relation to the transfer process. They are particularly experienced in offering guidance to foreign purchasers, helping them to navigate the specific features of a takeover process in French-speaking Switzerland, a marketplace densely populated with small and mid-sized companies.

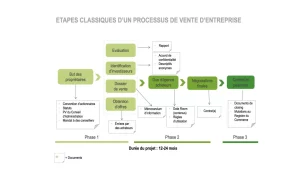

Transferring a business is a complex process. Firstly, the objective to be achieved must be fixed: sale to third parties, takeover by management, takeover within the family. A company valuation then needs to be carried out, which may lead to an overhaul or restructuring. The transfer itself must then be arranged, and all steps taken to ensure that the business operations can be sustained and expanded as far as possible post-transfer.

Only a lawyer can establish a complete overview of the issues. The transfer price is not the only factor to consider. A lawyer specialising in business transfers can anticipate issues that are likely to arise and plan the key steps. They will focus on the essential issues rather than getting side-tracked by legal minutiae. The lawyer can offer their wholly impartial support to the owner at all steps in the procedure. They can advise the owner on the best takeover scenarios. The lawyer can call on their network of expert professionals (fiduciaries/accountants, tax specialists, banks, communications experts) to ensure this complicated operation is successful.

First of all, the general framework for the negotiations will be set out in a letter of intent. Next, steps will be taken to ensure the information provided is kept confidential and the data room set up. Then the sale contract will be drafted. In parallel, careful consideration must be given to the expected tax implications and to the conditions for financing the takeover, because the transferor may remain one of the key players. Communications about the transfer are also of fundamental importance.

Ideally, this should not be done in a hurry. To start with, a ‘health check’ should be conducted on the business ahead of its transfer. The aim of this check-up is to establish an overview of the main legal and financial challenges facing the business and assess the consequences of this when it comes to setting objectives and deciding on the procedure to be followed. This allows the foundations for the transfer strategy to be cemented. In effect, a family business is not transferred within the owners’ family in the same way as it would be in the case of a sale to a competitor or a takeover by a private equity fund.

First of all, it is necessary to analyse and obtain an understanding of the general background to the business. Why is it being transferred, to whom, how and within what time frame?

An analysis of the strengths and weaknesses of the business and its background will then be carried out.

On this basis, a detailed analysis of the financial situation of the business will of course follow. What is it worth? Can this be improved?

Lastly, the contractual and legal framework will be drawn up to enable the objectives defined by the strategy to be achieved.

The preliminary analysis will therefore serve as a guideline or road map. It will be revised regularly during the transfer process and will be followed by a more detailed analysis or subsequent analyses, relating either to variations or specific points relevant to the particular situation of the business, its market, financial or legal circumstances or shareholder situation.

Our law firm has over twenty years’ experience in business transfers. This experience enables our lawyers to anticipate issues that are likely to arise and to advise the owner(s)/transferor(s) on setting realistic, achievable aims which can be implemented at legal, fiscal and financial levels. Our extensive network of independent consultants enables all aspects to be considered and ensure that the overall transfer process can be coordinated.

Our lawyers can certainly advise potential purchasers in relation to the transfer process. They are particularly experienced in offering guidance to foreign purchasers, helping them to navigate the specific features of a takeover process in French-speaking Switzerland, a marketplace densely populated with small and mid-sized companies.

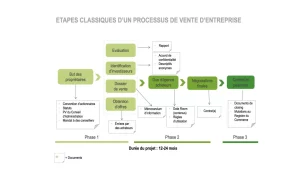

Transferring a business is a complex process. Firstly, the objective to be achieved must be fixed: sale to third parties, takeover by management, takeover within the family. A company valuation then needs to be carried out, which may lead to an overhaul or restructuring. The transfer itself must then be arranged, and all steps taken to ensure that the business operations can be sustained and expanded as far as possible post-transfer.

Only a lawyer can establish a complete overview of the issues. The transfer price is not the only factor to consider. A lawyer specialising in business transfers can anticipate issues that are likely to arise and plan the key steps. They will focus on the essential issues rather than getting side-tracked by legal minutiae. The lawyer can offer their wholly impartial support to the owner at all steps in the procedure. They can advise the owner on the best takeover scenarios. The lawyer can call on their network of expert professionals (fiduciaries/accountants, tax specialists, banks, communications experts) to ensure this complicated operation is successful.

First of all, the general framework for the negotiations will be set out in a letter of intent. Next, steps will be taken to ensure the information provided is kept confidential and the data room set up. Then the sale contract will be drafted. In parallel, careful consideration must be given to the expected tax implications and to the conditions for financing the takeover, because the transferor may remain one of the key players. Communications about the transfer are also of fundamental importance.

Ideally, this should not be done in a hurry. To start with, a ‘health check’ should be conducted on the business ahead of its transfer. The aim of this check-up is to establish an overview of the main legal and financial challenges facing the business and assess the consequences of this when it comes to setting objectives and deciding on the procedure to be followed. This allows the foundations for the transfer strategy to be cemented. In effect, a family business is not transferred within the owners’ family in the same way as it would be in the case of a sale to a competitor or a takeover by a private equity fund.

First of all, it is necessary to analyse and obtain an understanding of the general background to the business. Why is it being transferred, to whom, how and within what time frame?

An analysis of the strengths and weaknesses of the business and its background will then be carried out.

On this basis, a detailed analysis of the financial situation of the business will of course follow. What is it worth? Can this be improved?

Lastly, the contractual and legal framework will be drawn up to enable the objectives defined by the strategy to be achieved.

The preliminary analysis will therefore serve as a guideline or road map. It will be revised regularly during the transfer process and will be followed by a more detailed analysis or subsequent analyses, relating either to variations or specific points relevant to the particular situation of the business, its market, financial or legal circumstances or shareholder situation.

Our law firm has over twenty years’ experience in business transfers. This experience enables our lawyers to anticipate issues that are likely to arise and to advise the owner(s)/transferor(s) on setting realistic, achievable aims which can be implemented at legal, fiscal and financial levels. Our extensive network of independent consultants enables all aspects to be considered and ensure that the overall transfer process can be coordinated.

Our lawyers can certainly advise potential purchasers in relation to the transfer process. They are particularly experienced in offering guidance to foreign purchasers, helping them to navigate the specific features of a takeover process in French-speaking Switzerland, a marketplace densely populated with small and mid-sized companies.

Transferring a business is a complex process. Firstly, the objective to be achieved must be fixed: sale to third parties, takeover by management, takeover within the family. A company valuation then needs to be carried out, which may lead to an overhaul or restructuring. The transfer itself must then be arranged, and all steps taken to ensure that the business operations can be sustained and expanded as far as possible post-transfer.

Only a lawyer can establish a complete overview of the issues. The transfer price is not the only factor to consider. A lawyer specialising in business transfers can anticipate issues that are likely to arise and plan the key steps. They will focus on the essential issues rather than getting side-tracked by legal minutiae. The lawyer can offer their wholly impartial support to the owner at all steps in the procedure. They can advise the owner on the best takeover scenarios. The lawyer can call on their network of expert professionals (fiduciaries/accountants, tax specialists, banks, communications experts) to ensure this complicated operation is successful.

First of all, the general framework for the negotiations will be set out in a letter of intent. Next, steps will be taken to ensure the information provided is kept confidential and the data room set up. Then the sale contract will be drafted. In parallel, careful consideration must be given to the expected tax implications and to the conditions for financing the takeover, because the transferor may remain one of the key players. Communications about the transfer are also of fundamental importance.

Ideally, this should not be done in a hurry. To start with, a ‘health check’ should be conducted on the business ahead of its transfer. The aim of this check-up is to establish an overview of the main legal and financial challenges facing the business and assess the consequences of this when it comes to setting objectives and deciding on the procedure to be followed. This allows the foundations for the transfer strategy to be cemented. In effect, a family business is not transferred within the owners’ family in the same way as it would be in the case of a sale to a competitor or a takeover by a private equity fund.

First of all, it is necessary to analyse and obtain an understanding of the general background to the business. Why is it being transferred, to whom, how and within what time frame?

An analysis of the strengths and weaknesses of the business and its background will then be carried out.

On this basis, a detailed analysis of the financial situation of the business will of course follow. What is it worth? Can this be improved?

Lastly, the contractual and legal framework will be drawn up to enable the objectives defined by the strategy to be achieved.

The preliminary analysis will therefore serve as a guideline or road map. It will be revised regularly during the transfer process and will be followed by a more detailed analysis or subsequent analyses, relating either to variations or specific points relevant to the particular situation of the business, its market, financial or legal circumstances or shareholder situation.

Our law firm has over twenty years’ experience in business transfers. This experience enables our lawyers to anticipate issues that are likely to arise and to advise the owner(s)/transferor(s) on setting realistic, achievable aims which can be implemented at legal, fiscal and financial levels. Our extensive network of independent consultants enables all aspects to be considered and ensure that the overall transfer process can be coordinated.

Our lawyers can certainly advise potential purchasers in relation to the transfer process. They are particularly experienced in offering guidance to foreign purchasers, helping them to navigate the specific features of a takeover process in French-speaking Switzerland, a marketplace densely populated with small and mid-sized companies.

Transferring a business is a complex process. Firstly, the objective to be achieved must be fixed: sale to third parties, takeover by management, takeover within the family. A company valuation then needs to be carried out, which may lead to an overhaul or restructuring. The transfer itself must then be arranged, and all steps taken to ensure that the business operations can be sustained and expanded as far as possible post-transfer.

Only a lawyer can establish a complete overview of the issues. The transfer price is not the only factor to consider. A lawyer specialising in business transfers can anticipate issues that are likely to arise and plan the key steps. They will focus on the essential issues rather than getting side-tracked by legal minutiae. The lawyer can offer their wholly impartial support to the owner at all steps in the procedure. They can advise the owner on the best takeover scenarios. The lawyer can call on their network of expert professionals (fiduciaries/accountants, tax specialists, banks, communications experts) to ensure this complicated operation is successful.

First of all, the general framework for the negotiations will be set out in a letter of intent. Next, steps will be taken to ensure the information provided is kept confidential and the data room set up. Then the sale contract will be drafted. In parallel, careful consideration must be given to the expected tax implications and to the conditions for financing the takeover, because the transferor may remain one of the key players. Communications about the transfer are also of fundamental importance.

Ideally, this should not be done in a hurry. To start with, a ‘health check’ should be conducted on the business ahead of its transfer. The aim of this check-up is to establish an overview of the main legal and financial challenges facing the business and assess the consequences of this when it comes to setting objectives and deciding on the procedure to be followed. This allows the foundations for the transfer strategy to be cemented. In effect, a family business is not transferred within the owners’ family in the same way as it would be in the case of a sale to a competitor or a takeover by a private equity fund.

First of all, it is necessary to analyse and obtain an understanding of the general background to the business. Why is it being transferred, to whom, how and within what time frame?

An analysis of the strengths and weaknesses of the business and its background will then be carried out.

On this basis, a detailed analysis of the financial situation of the business will of course follow. What is it worth? Can this be improved?

Lastly, the contractual and legal framework will be drawn up to enable the objectives defined by the strategy to be achieved.

The preliminary analysis will therefore serve as a guideline or road map. It will be revised regularly during the transfer process and will be followed by a more detailed analysis or subsequent analyses, relating either to variations or specific points relevant to the particular situation of the business, its market, financial or legal circumstances or shareholder situation.

Our law firm has over twenty years’ experience in business transfers. This experience enables our lawyers to anticipate issues that are likely to arise and to advise the owner(s)/transferor(s) on setting realistic, achievable aims which can be implemented at legal, fiscal and financial levels. Our extensive network of independent consultants enables all aspects to be considered and ensure that the overall transfer process can be coordinated.

Our lawyers can certainly advise potential purchasers in relation to the transfer process. They are particularly experienced in offering guidance to foreign purchasers, helping them to navigate the specific features of a takeover process in French-speaking Switzerland, a marketplace densely populated with small and mid-sized companies.

Transferring a business is a complex process. Firstly, the objective to be achieved must be fixed: sale to third parties, takeover by management, takeover within the family. A company valuation then needs to be carried out, which may lead to an overhaul or restructuring. The transfer itself must then be arranged, and all steps taken to ensure that the business operations can be sustained and expanded as far as possible post-transfer.

Only a lawyer can establish a complete overview of the issues. The transfer price is not the only factor to consider. A lawyer specialising in business transfers can anticipate issues that are likely to arise and plan the key steps. They will focus on the essential issues rather than getting side-tracked by legal minutiae. The lawyer can offer their wholly impartial support to the owner at all steps in the procedure. They can advise the owner on the best takeover scenarios. The lawyer can call on their network of expert professionals (fiduciaries/accountants, tax specialists, banks, communications experts) to ensure this complicated operation is successful.

First of all, the general framework for the negotiations will be set out in a letter of intent. Next, steps will be taken to ensure the information provided is kept confidential and the data room set up. Then the sale contract will be drafted. In parallel, careful consideration must be given to the expected tax implications and to the conditions for financing the takeover, because the transferor may remain one of the key players. Communications about the transfer are also of fundamental importance.

Ideally, this should not be done in a hurry. To start with, a ‘health check’ should be conducted on the business ahead of its transfer. The aim of this check-up is to establish an overview of the main legal and financial challenges facing the business and assess the consequences of this when it comes to setting objectives and deciding on the procedure to be followed. This allows the foundations for the transfer strategy to be cemented. In effect, a family business is not transferred within the owners’ family in the same way as it would be in the case of a sale to a competitor or a takeover by a private equity fund.

First of all, it is necessary to analyse and obtain an understanding of the general background to the business. Why is it being transferred, to whom, how and within what time frame?

An analysis of the strengths and weaknesses of the business and its background will then be carried out.

On this basis, a detailed analysis of the financial situation of the business will of course follow. What is it worth? Can this be improved?

Lastly, the contractual and legal framework will be drawn up to enable the objectives defined by the strategy to be achieved.

The preliminary analysis will therefore serve as a guideline or road map. It will be revised regularly during the transfer process and will be followed by a more detailed analysis or subsequent analyses, relating either to variations or specific points relevant to the particular situation of the business, its market, financial or legal circumstances or shareholder situation.

Our law firm has over twenty years’ experience in business transfers. This experience enables our lawyers to anticipate issues that are likely to arise and to advise the owner(s)/transferor(s) on setting realistic, achievable aims which can be implemented at legal, fiscal and financial levels. Our extensive network of independent consultants enables all aspects to be considered and ensure that the overall transfer process can be coordinated.

Our lawyers can certainly advise potential purchasers in relation to the transfer process. They are particularly experienced in offering guidance to foreign purchasers, helping them to navigate the specific features of a takeover process in French-speaking Switzerland, a marketplace densely populated with small and mid-sized companies.

Newsletter

Keep in touch

expertise

© 2024 Wilhelm Avocats SA – Politique en matière de confidentialité – Réalisation Mediago